Introduction

DeFi, short for decentralized finance, has emerged as one of the most exciting developments in the crypto world. It allows individuals to passively earn, invest, borrow, and lend their assets without relying on traditional banking systems. While it may sound complex at first, understanding key DeFi terms is essential to navigate this space safely and effectively. In this blog post, we will explore and explain important DeFi concepts that every enthusiast should be familiar with.

Section 1: Collateral

Collateral plays a crucial role in certain lending platforms within the DeFi ecosystem. Users place collateral to secure loans denominated in different cryptocurrencies. For example, you can lock up your ETH on such a platform to borrow DAI or USDC tokens. Typically, the collateral value exceeds the borrowed amount (overcollateralization). For instance, platforms like Celsius allow users to borrow up to 25%, 33%, or 50% of their collateral’s value. Health Factor indicates the status of a loan – as long as it remains above 1, there is no immediate risk of liquidation; however, price fluctuations can impact this ratio. Loan-to-Value (LTV) ratio represents the proportion between the loan amount and the value of collateral deposited. For instance, a current LTV of $0.32 means that $1 worth of collateral enables you to borrow $0.32.

Section 2: DEX/CEX

DEX stands for decentralized exchange while CEX refers to centralized exchange platforms where users can buy and sell cryptocurrencies and tokens. DEXs operate independently using algorithms and smart contracts to manage assets, whereas CEXs are operated by companies or entities in a traditional manner. Some prominent DEXs include Uniswap and Kyber Network while popular CEXs include Coinbase and Binance. While trading fees may be lower on CEXs, some DEX platforms offer users greater control over their funds.

Section 3: DAO

DAO stands for Decentralized Autonomous Organization. It refers to an organization that operates without human management or a centralized hierarchy. All operations within a DAO are fully automated and utilize open-source code that is transparent and verifiable by anyone. Similar to DeFi, DAOs exist on the blockchain, making them immutable and censorship-resistant.

Section 4: dApp

dApp, short for decentralized application, is the foundation of the entire DeFi ecosystem. Similar to DAOs, dApps operate independently without intermediaries or central authorities, allowing users to send tokens or cryptocurrencies directly to each other. While Ethereum is the primary blockchain for hosting dApps, other blockchains like Tron and EOS also enable developers to create such applications.

Section 5: Ethereum

Considered one of the most important blockchains after Bitcoin, Ethereum is the birthplace of DeFi. It serves as a supercomputer where smart contracts can run and acts as a library for dApps.

Section 6: Gas Fee/Fees

Gas fees refer to transaction costs on the Ethereum blockchain. Miners receive these fees for processing transactions on the network. Gas fees are paid in ETH or its fractional unit called GWEI. Currently, due to high network congestion, transaction costs can be expensive, making it uneconomical for smaller amounts. Miners prioritize higher fee transactions, which may result in longer confirmation times for cheaper transactions.

Section 7: Smart Contract

The power of the Ethereum blockchain lies in smart contracts. These self-executing codes govern the operations of dApps and other blockchain protocols within DeFi. Unlike traditional contracts encountered daily that can be revised or modified, smart contracts are immutable. However, they may contain bugs that can lead to platform failures if exploited by malicious actors. To address this, many platforms now undergo rigorous audits to ensure security and stability. A simple example of a smart contract would be one that converts 1 ETH to its equivalent value in USDC upon receiving the ETH at a specific contract address.

Section 8: Stablecoins

Stablecoins are an essential component of DeFi and represent cryptocurrencies pegged to real-world fiat currencies. There are two types: algorithmic stablecoins, which do not require full backing by fiat reserves, and centralized stablecoins, which do require such backing. Examples of algorithmic stablecoins include DAI, while popular centralized stablecoins include USDT and USDC. Stablecoins provide relative stability in volatile markets and can also be used as a store of value within the DeFi ecosystem.

Section 9: Tokenomics

Tokenomics refers to the economics surrounding a cryptocurrency token or project. It encompasses the distribution, utility, and functionality of tokens, including factors like developer allocation, airdrops, marketing expenses, etc. Comprehensive tokenomics documents are crucial during initial stages to provide investors with insight into the project’s decision-making processes.

Section 10: Token

Tokens are often confused with cryptocurrencies like Bitcoin or Ether but function more similarly to stocks on traditional exchanges. Not all tokens hold intrinsic value. The most well-known tokens are ERC-20 tokens that exist on the Ethereum blockchain, forming a significant portion of the DeFi ecosystem. Some tokens confer governance rights to their holders, enabling them to participate in decision-making processes within DAOs/DEXs/dApps – these tokens are referred to as “governance” tokens.

Section 11: Liquidity Pool

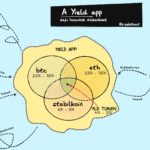

Liquidity pools are integral elements of DeFi protocols that allow users to provide liquidity for trading pairs (such as ETH-DAI). They serve as the foundation for decentralized exchanges and operate using smart contracts that maintain balance within the pools. Users who contribute liquidity often receive rewards, typically in the form of a percentage of fees collected by the platform (usually paid in the platform’s native token).

Section 12: Liquidity Mining

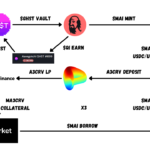

Also known as Yield Farming, liquidity mining involves depositing a cryptocurrency/token/LP into a DEX or dApp to earn rewards. Some platforms reward users with new tokens for staking their LP tokens. For instance, if you hold shares in a DAI-BSG liquidity pool, you can stake those LP tokens on Harvest.Finance and receive FARM tokens. This method can yield higher returns on investments but also carries increased risk.

Section 13: Harvest

Harvest refers to the process of reaping profits earned through DeFi activities. It is closely tied to liquidity mining and involves collecting yields generated from various protocols and sources within the ecosystem.

Section 14: NFT

NFT stands for Non-Fungible Token, which represents unique digital assets that cannot be replaced or exchanged on a like-for-like basis. While fungible tokens like ETH can be traded at an equal value, NFTs exist as one-of-a-kind items. They are commonly used for collectibles and artwork within the blockchain space and have gained popularity with projects like ERC-721 and ERC-1155.

Section 15: Pump and Dump

“Pump and Dump” refers to a manipulation technique where individuals or groups artificially inflate the price of a token through large purchases and subsequently sell it at a higher price once other investors start buying based on the perceived price increase. This practice is often observed during token launches when prices experience temporary spikes, leaving less fortunate buyers at a loss.

Section 16: MEV

MEV originally stood for Miner Extractable Value but has now been redefined as Maximal Extractable Value due to the transition towards proof-of-stake consensus mechanisms. In theory, miners/validators should receive all MEV for their efforts in validating transactions. However, with the involvement of searchers (complex algorithms/bots) seeking profit opportunities, they are willing to pay higher transaction fees to capture a larger share of profitable transactions. Miners and validators still receive a portion of MEV, but searchers often outbid them to extract more value.

Section 17: Merch

Merchandise or merch refers to branded items associated with a particular brand or project. While not strictly DeFi-related, many NFT projects offer merchandise as promotional or giveaway items. Examples include Adidas and Loomi Heads, who sell or provide free merch items. In some cases, users can purchase these items using points earned through NFT holdings.

Conclusion

This comprehensive guide has covered essential DeFi terms that every enthusiast should be familiar with. Understanding these concepts will help you navigate the decentralized finance space confidently and make informed decisions when participating in DeFi protocols and platforms. Remember to always exercise caution, conduct thorough research, and only invest what you can afford to lose in this rapidly evolving ecosystem.